how long does the irs have to collect back payroll taxes

The IRS is limited to 10 years to collect back taxes after that they are barred by law from continuing collection activities against you. Owe IRS 10K-110K Back Taxes Check Eligibility.

How To Sucessfully Negotiate Payroll Tax Relief With Irs

There is a penalty of 05 per month on the unpaid.

. As a general rule there is an established ten-year statute of limitations for the IRS to collect unpaid tax debts. The IRS generally has 10 years from the date of assessment to collect on a balance due. Owe IRS 10K-110K Back Taxes Check Eligibility.

The ten-year time period in which the IRS can collect back taxes begins on the date an IRS official signs the tax assessment. The collection statute expiration ends the. This means that under normal circumstances the IRS can no longer pursue collections action against you if.

Under Federal law there is a time restriction on how long the IRS has to collect unpaid taxes. We provide Immediate IRS Help to Stop Wage Garnishment and End Your Tax Problems. Trusted A BBB Member.

Generally the IRS can include returns filed within the last three years in an audit. Ad Owe back tax 10K-200K. The IRS statute of limitations period for collection of taxes the IRS filing suit against the taxpayer to collect previously assessed taxes is generally ten years.

See if you Qualify for IRS Fresh Start Request Online. How far back does the IRS go to collect back taxes. Possibly Settle Taxes up to 95 Less.

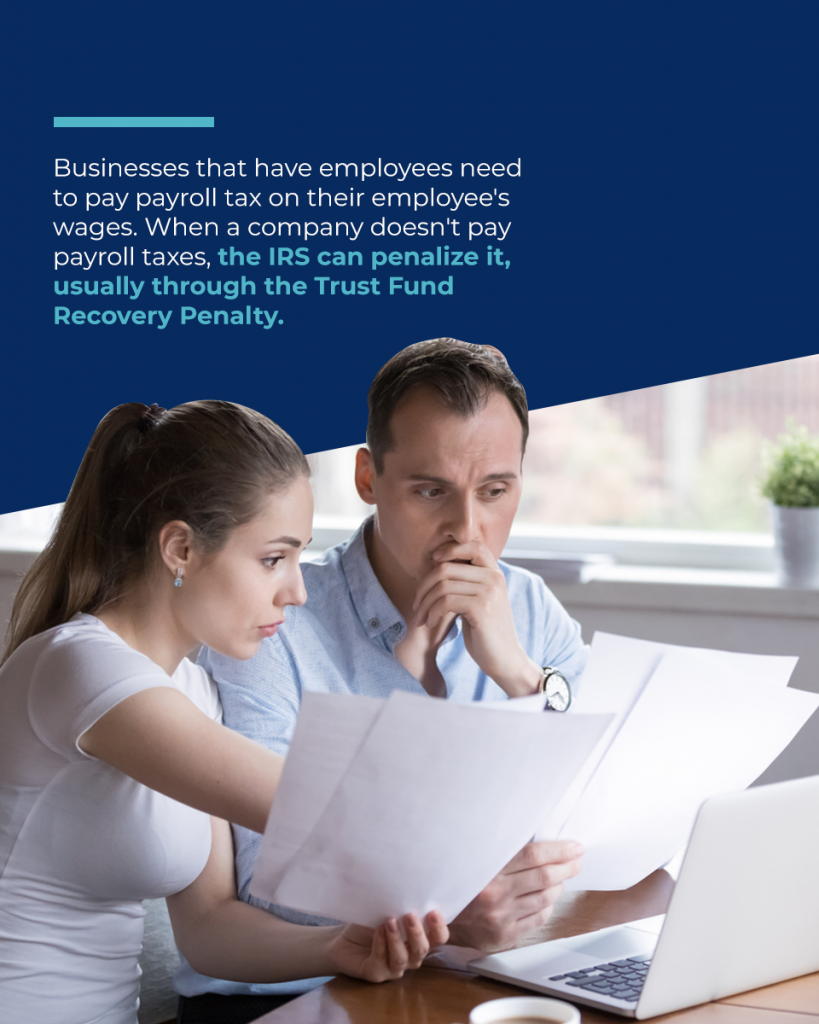

There is an IRS statute of limitations on collecting taxes. Generally under IRC 6502 the IRS will have 10 years to collect a liability from the date of assessment. Unpaid payroll taxes are referred to by the IRS as trust fund taxes.

This is known as the. The 10-year deadline for collecting. The IRS has a set collection period of 10 years.

Generally under IRC 6502 the IRS will. Take Advantage of Fresh Start Program. Theres no fee to request the extension.

As already hinted at the statute of limitations on IRS debt is 10 years. How long does IRS give you to pay back taxes. Short-term payment plan The payment period is 120 days or less and the total amount owed is less than 100000 in combined tax penalties.

The IRS is limited to 10 years to collect back taxes after that they are barred by law from continuing collection. The IRS will provide up to 120 days to taxpayers to pay their full tax balance. If you cannot pay what you owe you can request an additional 60-120 days to pay your account in full through the Online Payment Agreement application or by calling 800-829.

IRS Direct Pay is free and available at IRSgovDirectPay where you can securely pay your taxes directly from your checking or savings accounts without any fees or pre-registration. How far back can the IRS collect unpaid taxes. Generally under IRC 6502 the IRS will have 10 years to collect a liability from the date of assessment.

A tax assessment determines how much you owe. A trust fund tax is a money withheld from an employees wages income tax Social Security and Medicare taxes that is. If we identify a substantial error we may add.

See if you Qualify for IRS Fresh Start Request Online. How Long Does The IRS Have To Collect Back Taxes. Ad Owe back tax 10K-200K.

Ad File Settle Back Taxes. Get Your Qualification Options for Free. This time restriction is most commonly known as the statute of limitations.

Ad Use our tax forgiveness calculator to estimate potential relief available. This is the length of time it has to pursue any tax payments that have not been made. How many years can the IRS collect back taxes.

Essentially the IRS is mandated to collect your unpaid taxes. IRC Section 6502 provides that the length of the period for collection after assessment of a tax liability is 10 years.

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

How To Sucessfully Negotiate Payroll Tax Relief With Irs

Payroll Taxes Filing And Paying Back Taxe By Payrolltwentytwenty Issuu

Know When And How To Pay Payroll Taxes To The Irs Blog

What Assets Can The Irs Legally Seize To Satisfy Tax Debt Paladini Law

How Far Back Can The Irs Collect Unfiled Taxes

Will The Irs Collect And Seize My Home Or Assets Landmark Tax Group

The Consequences Of Willful Failure To Pay Payroll Taxes

What Taxpayers Must Know About The Irs 10 Year Statute Of Limitations Landmark Tax Group

Video Irs 1099 Levy Contractor Options Turbotax Tax Tips Videos

What Is Tax Resolution Solving Irs Tax Problems

What To Expect When You Owe Back Payroll Taxes

Irs Hardship Currently Non Collectable Alg

Can I Set Up A Payment Plan For Unpaid Payroll Taxes

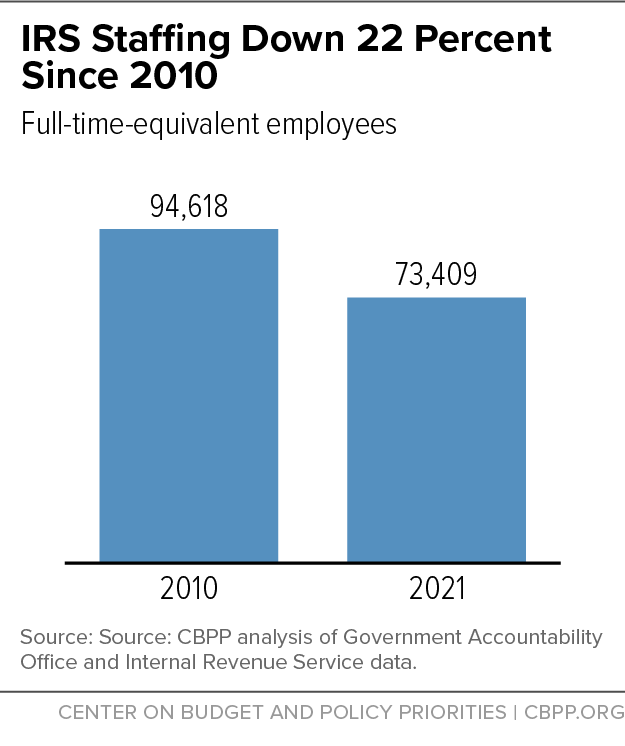

Policy Basics Federal Payroll Taxes Center On Budget And Policy Priorities

What Taxpayers Must Know About The Irs 10 Year Statute Of Limitations Landmark Tax Group

Congress Needs To Take Two Steps To Fund The Irs For The Short And Long Term Center On Budget And Policy Priorities

:max_bytes(150000):strip_icc():gifv()/how-long-to-keep-state-tax-records-3193344-V22-3972fe8732794cc596ab2cac3cd979c3.png)